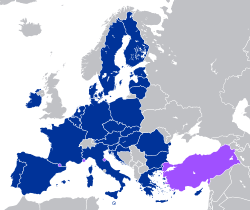

The European Union Customs Union (EUCU), formally known as the Community Customs Union, is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU states do not participate in the customs union, usually as a result of their geographic separation.[a] In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey (with the exceptions of certain goods),[b] through separate bilateral agreements.[2]

European Union Customs Union | |

|---|---|

Non-EU states which participate in the customs union, or are in bilateral customs unions with the EU | |

| Type | Customs union |

| Membership | 27 EU member states 5 states/territories with bilateral agreements |

| Establishment | 1968[1] |

| Area | |

• Total | 4,950,000 km2 (1,910,000 sq mi) |

| Population | |

• 2021 estimate | |

| GDP (PPP) | 2021 estimate |

• Total | |

| GDP (nominal) | 2021 estimate |

• Total | |

There are no tariffs or non-tariff barriers to trade between the members of the customs union and – unlike a free-trade area – members of the customs union impose a common external tariff on all goods entering the union.[3]

The European Commission negotiates for and on behalf of the Union as a whole in international trade deals, rather than each member state negotiating individually. It also represents the Union in the World Trade Organization and any trade disputes mediated through it.

Common external tariffs edit

The EU Customs Union sets the tariff rates for imports to the EU from other countries. These rates are detailed and depend on the specific type of product imported, and can also vary by the time of year.[4] The full WTO Most Favoured Nation tariff rates apply only to those countries that do not have a Free Trade Agreement with the EU, or are not on a WTO recognised exemption scheme such as Everything but Arms (an EU support arrangement for Least Developed Countries).

Union and common transit edit

Union transit, formerly called "Community transit", is a system generally applicable to the movement of non-Union goods for which customs duties and other charges due on import have not been paid, and of Union goods, which, between their point of departure and point of destination in the EU, have to pass through the territory of a third country.[5]

The 'common' transit procedure is used for the movement of goods between the EU Member States, the EFTA countries (Iceland, Norway, Liechtenstein and Switzerland), Turkey (since 1 December 2012), the Republic of North Macedonia (since 1 July 2015) and Serbia (since 1 February 2016). The operation of the common transit procedure with the UK is ensured as the UK has deposited its instrument of accession on 30 January 2019 with the Secretariat of the Council of the EU.[5] The procedure is based on the Convention of 20 May 1987 on a common transit procedure. The rules are effectively identical to those of the Union transit.[5]

Edward Kellett-Bowman MEP, as rapporteur for a European Parliament Committee of Inquiry, presented a report to the Parliament in February 1997 [6] which identified the removal of border controls and a lack of co-operation by member states as being responsible for a rise in organised crime and smuggling.[7] Kellett-Bowman's report led to the European Union setting up a customs investigation body and computerising transit-monitoring systems.[8]

Modernised Customs Code edit

The Modernised Customs Code (MCC) was adopted under Regulation (EC) No 450/2008 of the European Parliament and of the Council of 23 April 2008 laying down the Community Customs Code (Modernised Customs Code).[9] The MCC was primarily adopted to enable IT customs and trade solutions to be adopted.[10]

Union Customs Code edit

The Union Customs Code (UCC), intended to further modernise customs procedures, entered into force on 1 May 2016. This superseded the MCC.[10] The European Commission has stated that the aims of the UCC are simplicity, service and speed.[11] Implementation took place over a period of time and most aspects of implementation were complete by 31 December 2020, although some formalities managed by electronic systems may not be fully implemented until 2025.[12]

One major goal of the UCC is to progress towards the complete use of electronic systems for interactions between businesses and customs authorities, and between customs authorities, bringing all paper-based customs processes to an end.[13]

Non-EU participants edit

Monaco and the British Overseas Territory of Akrotiri and Dhekelia are integral parts of the EU's customs territory.[2][14]

| State / territory | Agreement | Entry into force |

|---|---|---|

| Monaco | Franco-Monegasque Customs Convention[15][16][17] | 1968 |

| Akrotiri and Dhekelia (United Kingdom) | Treaty of Accession 2003[18] Brexit withdrawal agreement[14] |

1 May 2004 |

EU territories with opt-outs edit

While all EU member states are part of the customs union, not all of their respective territories participate. Territories of member states which have remained outside of the EU (overseas territories of the European Union) generally do not participate in the customs union.[19]

However, some territories within the EU do not participate in the customs union for tax and/or geographical reasons:

- Büsingen am Hochrhein (German exclave within Switzerland, part of the Swiss Customs Area)[20][21]

- Heligoland (small German archipelago in the North Sea with VAT free status)[20][19]

- Livigno (remote Alpine town in Italy with VAT free status)[20][21]

- Ceuta and Melilla (Spanish territories in Africa with VAT free status).[20][21]

Historical opt outs edit

The following territories were excluded until the end of 2019:

- Campione d'Italia (an exclave of Italy surrounded by Swiss territory)

- the Italian waters of Lake Lugano

Bilateral customs unions edit

Andorra, San Marino and Turkey are each in a customs union with the EU.[2]

| State | Agreement | Entry into force | Notes |

|---|---|---|---|

| Andorra | Agreement in the form of an Exchange of Letters between the European Economic Community and the Principality of Andorra – Joint Declarations[22] | 1 January 1991 | Excludes agricultural produce |

| San Marino | Agreement on Cooperation and Customs Union between the European Economic Community and the Republic of San Marino[23] | 1 April 2002 | |

| Turkey | Decision No 1/95 of the EC-Turkey Association Council of 22 December 1995 on implementing the final phase of the Customs Union[24] | 31 December 1995 | Excludes agricultural produce |

Special arrangements concerning territories of the United Kingdom edit

The United Kingdom of Great Britain and Northern Ireland left the European Union on 31 January 2020 and transition arrangements ended on 31 December 2020. Special arrangements have been made for those parts of the United Kingdom and its territories that share a land border with an EU member state.

Northern Ireland edit

The UK (including Northern Ireland) is no longer a member of the European Union Customs Union. However there are special arrangements in place for Northern Ireland: its trade with Great Britain and its trade with the European Union are each now regulated by the Brexit withdrawal agreement (specifically the Northern Ireland Protocol and the Windsor Framework), the EU–UK Trade and Cooperation Agreement, the European Union (Future Relationship) Act 2020, the United Kingdom Internal Market Act 2020. These include special provisions for trade in goods between Northern Ireland and the EU which for many purposes are similar to those that apply within the Customs Union, although Northern Ireland remains part of United Kingdom Customs territory.

Gibraltar edit

Gibraltar left the EU concurrently with the United Kingdom. When part of the EU, it was one of the EU territories with opt-outs and had not been part of the Customs Union. An agreement in principle has been reached between the EU, the United Kingdom, and Gibraltar to negotiate a treaty which would include provisions for trade on goods between the EU and Gibraltar.[25] These would be "substantially similar" to those within the Customs Union. As of April 2024[update] the agreement has not yet been concluded.

Akrotiri and Dhekelia edit

As already noted above, the British Overseas Territory of Akrotiri and Dhekelia on the island of Cyprus are integral parts of the EU's customs territory.

See also edit

- Community preference – Former principle of EU governance

- European Union value added tax – EU-wide goods and services tax policy

- European Customs Information Portal – EU Import/Export information service

- European Economic Area (EU and EFTA except Switzerland)

- European Free Trade Association (EFTA)

- European integration – Process of political, economic, social, and cultural integration of states in and around Europe

- European Single Market – Single market of the European Union and participating non-EU countries

- European Union–Turkey Customs Union – Customs union between Turkey and European Union

- Free trade areas in Europe – EU, EFTA, CEFTA, CISFTA, GUAM, BAFTA

- Free-trade area – Regional trade agreement

- Market access – Ability to sell goods and services across borders

- Non-tariff barriers to trade – Type of trade barriers

- Rules of origin – Rules to attribute a country of origin to a product

- Tariff – Goods and services import/export tax

Explanatory footnotes edit

- ^ For example, the one exclave of Germany within Switzerland.

- ^ See European Union–Turkey Customs Union.

References edit

- ^ Dinan, Desmond (2014). Europe Recast: A History of European Union (2nd ed.). Basingstoke, New York: Palgrave Macmillan. p. 88. ISBN 978-0-333-69352-0.

- ^ a b c Customs unions, Taxation and Customs Union Archived 17 August 2016 at the Wayback Machine, European Commission. Retrieved 20 August 2016.

- ^ Erskine, Daniel H (2006). "The United States-EC Dispute Over Customs Matters: Trade Facilitation, Customs Unions, and the Meaning of WTO Obligations". Florida Journal of International Law. 18: 432–485. SSRN 987367.

- ^ Taric and Quota Data & Information Archived 24 July 2019 at the Wayback Machine – European Commission Communication and Information Resource Centre for Administrations, Businesses and Citizens.

- ^ a b c European Union, Union and Common Transit Archived 9 August 2020 at the Wayback Machine, accessed 24 December 2020 Text was copied from this source, which is available under a Creative Commons Attribution 4.0 International License Archived 16 October 2017 at the Wayback Machine.

- ^ European Parliament, Report on the Community Transit System Archived 19 January 2022 at the Wayback Machine, 20 February 1997, accessed 31 January 2017

- ^ Neil Buckley, "Cross-border crime loses EU billions: Inquiry blames Brussels and customs for failing to clamp down on smuggling", Financial Times, 21 February 1997, p. 2.

- ^ Neil Buckley, "EU plans single body against smuggling", Financial Times, 13 March 1997, p. 2.

- ^ OJ L 145, published 4 June 2008

- ^ a b Deloitte Netherlands, "In 2016 the European Union will have a new Customs Code. But what’s new?", published 17 December 2014, accessed 11 December 2023.

- ^ "Union Customs Code". Taxation and customs union – European Commission. Archived from the original on 17 August 2016. Retrieved 25 May 2016.

- ^ European Commission, "The Union Customs Code (UCC) – Introduction". Archived 31 May 2019 at the Wayback Machine, accessed 29 March 2023.

- ^ European Commission, "Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 952/2013 to prolong the transitional use of means other than the electronic data-processing techniques provided for in the Union Customs Code", COM(2018) 85 final, published 2 March 2018, accessed 29 March 2023. Archived 5 June 2023 at the Wayback Machine.

- ^ a b Protocol relating to the Sovereign Base Areas of the United Kingdom of Great Britain and Northern Ireland in Cyprus Archived 11 October 2021 at the Wayback Machine, Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community, EUR-Lex, 12 November 2019.

- ^ "Taxation and Customs – FAQ". European Commission. Archived from the original on 8 June 2012. Retrieved 12 September 2012.

- ^ "Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code". Official Journal of the European Union. 19 October 1992. Archived from the original on 29 July 2017. Retrieved 12 September 2012.

- ^ "Monaco and the European Union". Gouvernement Princier. Archived from the original on 20 January 2021. Retrieved 31 January 2021.

- ^ Protocol No. 3 on the Sovereign Base Areas of the United Kingdom of Great Britain and Northern Ireland in Cyprus Archived 13 November 2020 at the Wayback Machine, Act concerning the conditions of accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic and the adjustments to the Treaties on which the European Union is founded, EUR-Lex, 23 September 2003.

- ^ a b Territorial status of EU countries and certain territories Archived 3 July 2021 at the Wayback Machine – European Commission, retrieved 18 December 2018

- ^ a b c d Article 6 of Council Directive 2006/112/EC Archived 29 June 2019 at the Wayback Machine, 28 November 2006

- ^ a b c "REGULATION (EU) No 952/2013 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 9 October 2013 laying down the Union Customs Code, Article 4" (PDF). EURLEX. October 2013. p. 11. Archived from the original on 14 August 2019. Retrieved 17 December 2018.

- ^ "Andorra: Customs Unions and preferential arrangements". European Commission. Archived from the original on 26 October 2012. Retrieved 12 September 2012.

- ^ "Agreement on Cooperation and Customs Union between the European Economic Community and the Republic of San Marino". Archived from the original on 7 April 2013. Retrieved 15 July 2015.

- ^ "Decision No 1/95 of the EC-Turkey Association Council of 22 December 1995 on implementing the final phase of the Customs Union" (PDF). Archived (PDF) from the original on 19 March 2013.

- ^ Martin, Maria; González, Miguel (11 January 2021). "Deal between Spain and UK plans to eliminate Gibraltar border checkpoint". El Pais. Madrid. Archived from the original on 25 May 2023. Retrieved 29 January 2021.

External links edit

- TARIC database enquiry system, gives current tariff rates applicable by exporting country and season – European Commission: Communication and Information Resource Centre for Administrations, Businesses and Citizens.

- TARIC and Quota Data & Information: user guides for the TARIC database above – European Commission: Communication and Information Resource Centre for Administrations, Businesses and Citizens.

- "Turkey border gridlock hints at pain to come for Brexit Britain". Financial Times, February 16, 2017